Does Philip Roesel The Owner Of Credit Card Services

Editor's note: Seeking Alpha is proud to welcome Culper as a new contributor. It's easy to get a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors as well get costless admission to the SA PRO archive. Click hither to find out more »

QuinStreet (NASDAQ:QNST) is a spider web i.0 atomic number 82 gen business. Information technology claims to generate "qualified" leads via search engines, visitor-owned websites, email campaigns, and partnerships, which it then sells to advertisers on a per-lead or per-click basis. The Company has historically generated the majority of revenues from its Education vertical, i.e. for-turn a profit colleges. However, the refuse in the for-profit education industry left the Company in a precarious position.

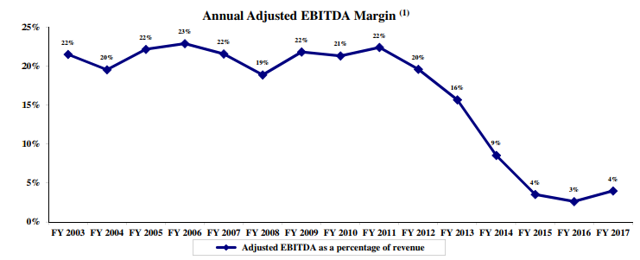

(Source: Company-produced chart)

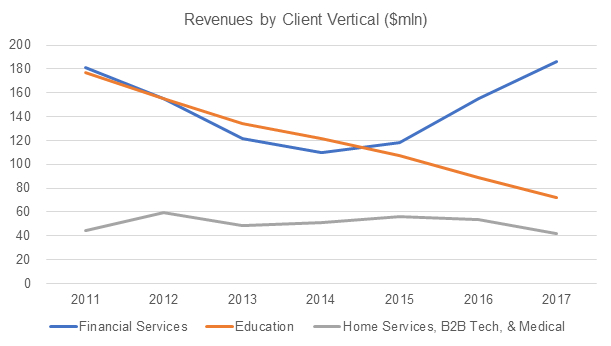

(Source: author, using public company filings)

Yet, the Company has managed to grow revenues via the Financial Services vertical equally shown. These customers consist primarily of insurance companies, as well as, to a bottom extent, mortgage providers, credit card providers, etc.

By management'due south ain access, the bulk of the Company's business organization and over 100% of growth has been the result of the "implementation of new products and media strategies." And then, what exactly do these strategies entail? Per direction, (1) mix shift to click-based products and (2) technological advantages are responsible.

…So as you lot see, as a mix shift away from leads, which is the dominant production in Pedagogy, into clicks, which is the ascendant product in motorcar insurance.

Nosotros used to merely do clicks in car insurance. And the new -- our new click platform now represents over -- which was only launched in March, now represents well over 60%. It is actually probably closer to seventy% now of our click revenue. And those products, again -- and that product is driving new pricing and new leverage and new media acquisition for united states, so information technology'southward beyond the various product sets. It's resulting in potent growth as nosotros indicated. That potent growth, we saw that sequentially this quarter, and we look to meet it twelvemonth-over-year in the existing quarter and in future quarters and to meet it very strongly this quarter and in future quarters to the melody of more than 25% year-over-year growth in Financial Services, which is, of course, now our largest business concern vertical, or client vertical and largest concern.

Thus, per management's own admission, this click-based platform and its associated "new products and media strategies" have reinvigorated a business that was otherwise left for dead, with shares up ~143% over the by twelvemonth.

(Source: Google Finance)

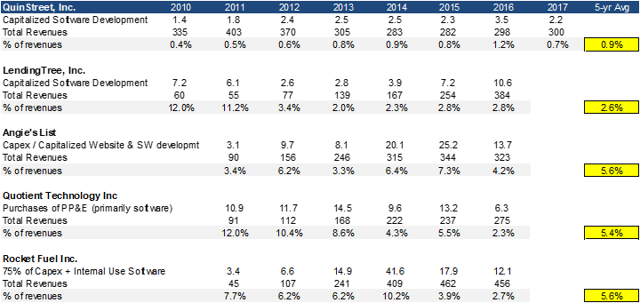

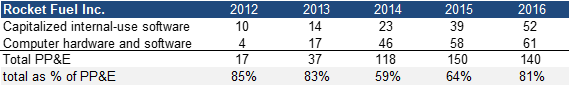

Management would also similar to take investors believe that some sort of omnipotent "technology" is somehow driving results, still over the past v years, the Visitor has on average spent merely 0.9% of revenues on capitalized software development as compared to peers such as LendingTree at ii.6%, Angie's List at 5.6%, Caliber Applied science at 5.4%, and Rocket Fuel (estimated) at 5.6%. Thus, we believe that QuinStreet'south tech platform actually lags its peers.

The question then becomesk; "What is really driving these results?"

Our research suggests that the Company has produced these results as a result of numerous dubious tactics designed to deceive both users (i.east. leads) and atomic number 82 buyers. Each of these claims is expanded upon in detail beneath, while links to noted lawsuits tin be found hither. Namely,

- QuinStreet and its partners sites allegedly utilize an illegal tactic called "cyber squatting" wherein users are deceived into assertive that they are on an actual insurance visitor's site rather than a lead gen site. QuinStreet and its partners have been sued by numerous parties for these actions. (see Windows USA and The General complaints linked above, Insurance Depot complaint hither).

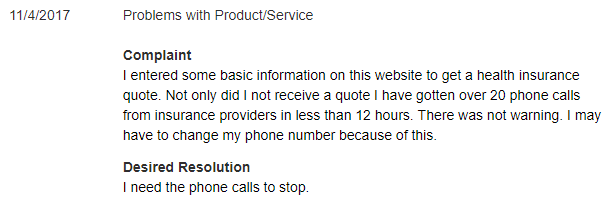

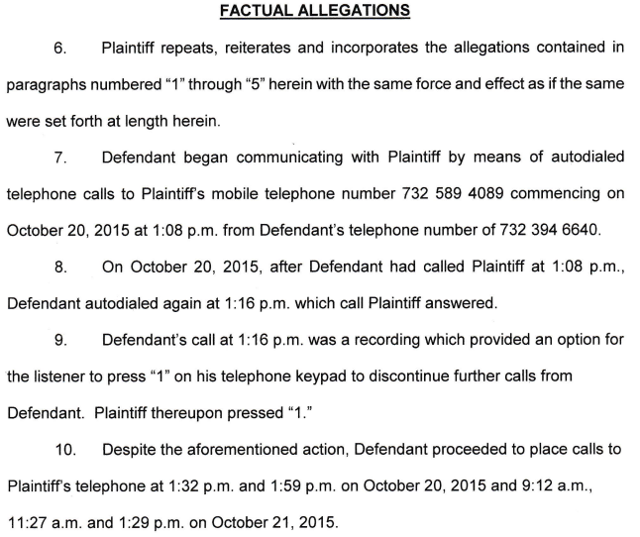

- While website users input user information with the expectation of beingness issued a quote, they are instead bombarded with phone calls and text messages that violate the Telephone Consumer Protection Human activity (TCPA). We have constitute numerous suits against QuinStreet and its partners for these violations (run across Becker, Sullivan, Barrera, Heiman, Lamberis, Ramos, Debusk, and Abramson complaints linked above, as a start).

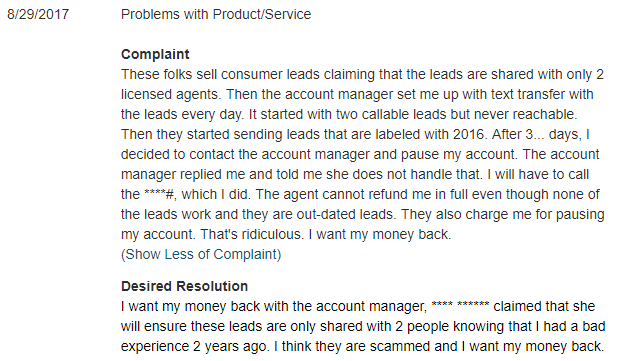

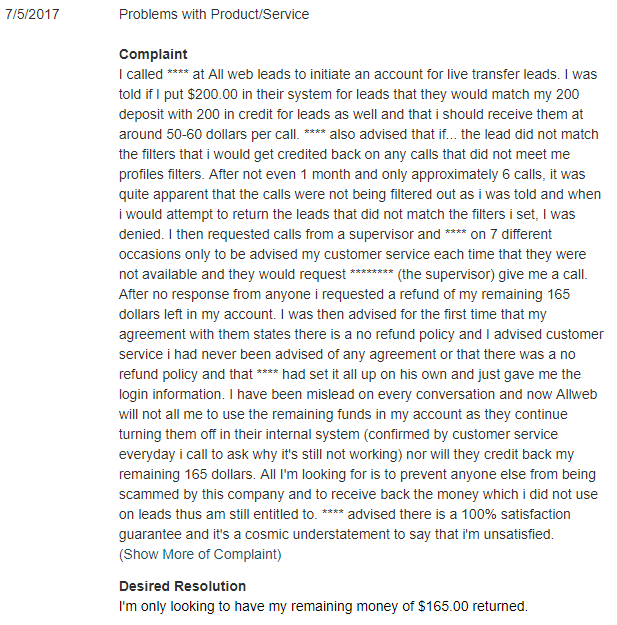

- While lead buyers are told that leads will be sold no more than than twice, hence making them "more valuable" to the customer, QuinStreet'southward own language implies leads are sold up to v times, while partners such as AWL let up to viii times, customer complaints claim over five times, and potential customers complain of having received "over 20 calls." (see client complaints below, Sullivan suit, and our study of QuinStreet websites below).

- While pb buyers are told that the leads are qualified through a "triple verification process," we believe the vast majority of these leads are depression quality (see customer complaints in the commentary below).

- While lead buyers are told that leads are "fresh" i.e. actionable, customers claim that QuinStreet has sold leads upward to 2 years one-time (see client complaints below).

- While customers wait to receive their money back for low quality leads, in many cases, QuinStreet only hasn't issued it. In fact, the Visitor's mis-marking of "non-standard revenue credits" led to a misstatement of financials and demonstrated weakness in internal controls as recently as June 30, 2017 (see customer reviews and complaints hither, here, and here).

Note that nosotros reached out to management for comment on these claims and more, nevertheless did not receive a response.

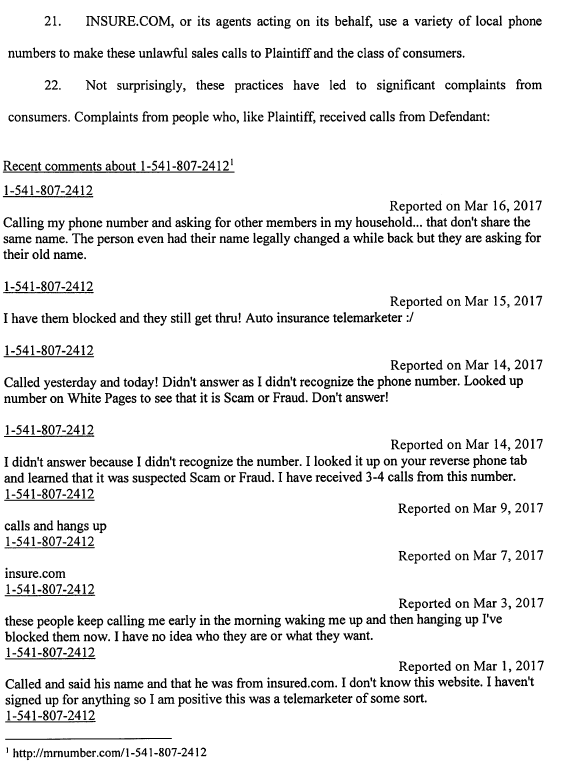

This wouldn't exist the first fourth dimension that a lead generation business, even QuinStreet itself, has come up nether scrutiny for these sorts of actions.

In 2012, the Company was investigated past the VA for portraying its websites as government agencies in order to deceive veterans into submitting information which was so sold to for-profit educators. The VA fined the Company $2.5mln and QuinStreet forfeited those sites. Notably, the Visitor yet made apply of the war machine.com and GIJobs.com websites which remained under its ownership.

Furthermore, Bankrate came nether scrutiny for similar practices in 2011 and 2012, leading to the business concern's undoing.

(Source: Google Finance)

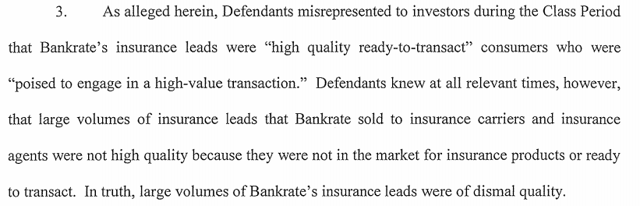

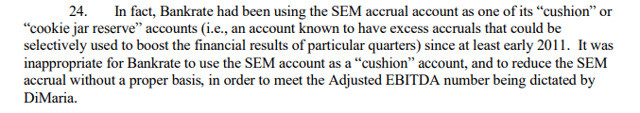

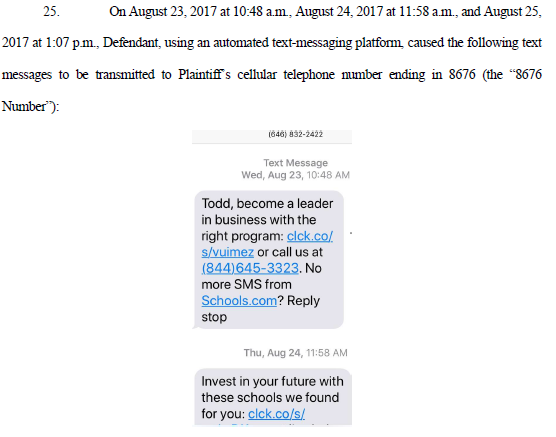

In its fourth dimension as a publicly traded visitor, information technology was declared of RATE that,

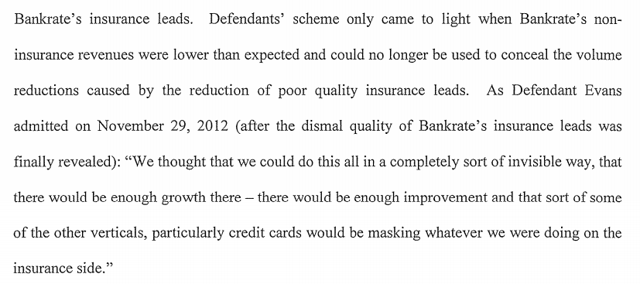

- "at least forty% of the insurance leads sold were of poor quality" (page 17).

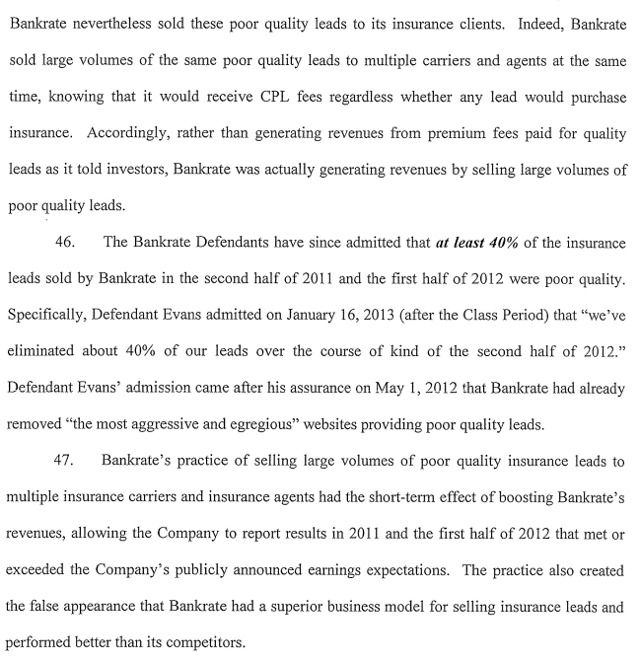

- the visitor "thought that we could practise this all in a completely sort of invisible way, that there would exist enough growth in that location - there would be plenty improvement and that sort of some of the other verticals, particularly credit cards would be masking whatever we were doing on the insurance side." (page 5)

- and that "Bankrate had been using the SEM accrual account as one of its 'absorber' or 'cookie jar reserve' accounts ... in lodge to meet the Adjusted EBITDA number beingness dictated..."

The SEC'due south stop and desist filing to Bankrate can exist found hither. Bankrate was forced to restate financials in 2014, the effects of which tin can still be institute in the near recent 10-K. Farther, though Bankrate settled with the SEC in September 2014, its executives still face up SEC fraud charges equally of September 2016. Finally, the most recent ten-K reveals that Charge per unit remains subject to a Department of Justice investigation.

Interestingly plenty, QuinStreet is now partnered with this same insurance business organisation through All Web Leads, and we believe that AWL and other partnerships have become integral to the Company's contempo results:

- In Nov 2015, All Web Leads announced an agreement to acquire Bankrate's insurance division.

- In February 2016, QuinStreet appear an sectional ten-year partnership with All Web Leads.

- In May 2016, management stated that,

"During the quarter, we successfully integrated with All Web Leads and are already seeing significant revenue and new opportunities from -- for growth from the partnership. We expect growth in Financial Services to accelerate in Q4 as strategic partnerships like AWL ramp and every bit mortgage and credit cards continue to scale."

(Source: HBO's Silicon Valley, writer note)

While management would like investors to believe that AWL has been "cleaned up" since the partnership was formed, nosotros demonstrate that numerous customer complaints and reviews, lawsuits against QuinStreet and its partners, and testimony from 2 of QuinStreet's own employees all run counter to this claim.

Per the Visitor's own hazard disclosures, it could be liable for not but its own actions, merely those of its partners. This potential liability is one that we believe investors are sorely overlooking, especially given the numerous lawsuits, TCPA-related and otherwise, that have been filed against the Company and its partners. In fact, recently appointed FCC Chairman Ajit Pai stated in March 2017 that "our March agenda is a full one … Topping the list will be a proposal to combat the top source of consumer complaints to the FCC: robocalls." Pai got to work quickly,

- In June 2017, DISH Network (DISH) was fined $280mln for TCPA violations.

- In June 2017, Adrian Abramovich of Marketing Strategy Leaders was fined $120mln for a spoofed robocall entrada.

- In August 2017, Philip Roesel, owner of "Best Insurance Contracts" in Northward Carolina, was fined $82mln for illegal robocalls - $1,000 per incident.

Nosotros believe that if the FCC has already demonstrated involvement in these players, it would exist even more interested in QuinStreet. Given both (ane) the importance of these tactics to QuinStreet'southward business organisation model and (2) the magnitude of the fines levied against these companies, we believe investors are massively underestimating the impact of a potential FCC action.

Even should the FCC (or FTC/other regulatory bodies) not take action confronting QuinStreet, in that location are numerous additional red flags which have the potential to permanently impair the business in swift social club.

Progressive Corp. was 17% of revenues in FY 2017. Should the visitor ultimately determine that its marketing dollars are better spent elsewhere, QuinStreet would face a severe revenue and earnings cliff. The vast majority of the Progressive concern is on the company side rather than a collection of individual agencies.

Our inquiry indicates that the Visitor relies on Google (GOOG) (GOOGL) to drive the vast majority of site traffic; a single algorithm change could prove detrimental to the concern overnight. These are the same fates that businesses such as Demand Media, RetailMeNot, or Rocket Fuel faced.

- Demand Media's marketplace cap shrunk from over $2bln to under $150mln after Google recalibrated its search engine formula in 2011.

- In 2014, RetailMeNot sold off 20% over but two days later a written report establish that its visibility had fallen 33% on Google'south search engine.

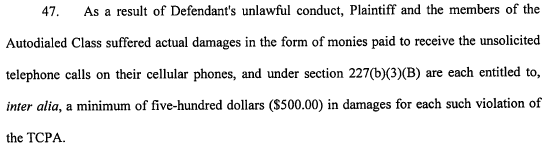

- In November 2017, Sizmek close downwardly the Rocket Fuel make "to focus on ad transparency" subsequently having purchased it for $145mln simply a few months earlier.

Given that the Company failed to renew its revolver in June 2017, liquidity and solvency could get issues.

With respect to valuation of the Visitor's equity, nosotros believe:

- QuinStreet is an outdated, low-tech, Web 1.0 business that is structurally incapable of producing cash period.

- The Company has recently begun towing the line on numerous practices in social club to attempt ane terminal shot at keeping itself afloat. These practices are wholly unsustainable both due to their questionable legality and their effect on alienating the Company'due south customer base and lead gen base of operations, leading to increased churn.

- Without these methods, the Company would be unable to generate greenbacks flow.

- The Visitor's internet cash position of $1.10 per share could face pressure should the FCC or other regulatory bodies result fines.

- Thus, given a lack of cash generation power and just $i.10 of net greenbacks, nosotros assign a generous $2.00 price target, for ~80% downside.

QuinStreet is a lead gen concern, not a technology business

Given the storied history of both QuinStreet and the greater atomic number 82 gen industry, it is understandable why management hopes to foster a view that the Company is actually in the technology business.

Indeed, the very offset sentence of the business clarification in the 10-K reads,

We are a leader in functioning marketing products and technologies. Our approach to proprietary performance marketing technologies allows clients to appoint loftier intent digital media or traffic from a broad range of device types (e.g., mobile, desktop, tablet), in multiple formats or types of media (e.1000., search engines, big and small media backdrop or websites, email), and in a broad range of cost-per-activeness, or CPA, forms.

And the Company and so claims that,

Our competitive advantages include our media buying power, proprietary technologies, extensive data and feel in performance marketing, and meaning online media market place share in the markets or verticals we serve.

This "tech" theme is ane reiterated throughout the Company's filings and by the sell-side. The Visitor states in its form x-K that,

Our proprietary technologies have been developed over the past 18 years to permit us to best segment and lucifer media or traffic, to deliver optimized results for our clients and to operate our loftier volume and highly circuitous channel toll-efficiently.

Sell-side analysts just take management at their discussion that the Visitor holds some sort of technological advantage, permit alone any proprietary tech at all. Per a December 2017 Barrington Research piece on the Company,

We hosted management on a series of investor meetings. A number of issues created some recurring themes. Perhaps none of direction's assertions was more emphatic than the notion that QuinStreet is engaged in digital functioning marketing, non lead generation. Very few people are in sales. Emphasis is on engineering, with roughly xxx% of the employee base of operations comprised of engineers who create the most engineering science‐driven company in the industry.

We find information technology interesting that the sell-side notes "management's assertions" that "QuinStreet is engaged in digital performance marketing, not lead generation" and that "accent is on engineering." The analysts then claim that,

What QuinStreet strives for in terms of an operational objective is reasonably easy to grasp. Executing on this ambition is more difficult to achieve. Applied science is the differentiating factor, and this is the business moat that provides confidence in the sustainability and expansion potential of the QuinStreet business model.

Quite frankly, we take no thought what whatsoever of this ways. One could just as well substitute "Nike," "Disney," or "Carmax" in the place of "QuinStreet" and the sentence would make just equally much sense. Yet, none of these are technology companies. Farther, it ought to exist a carmine flag in investors' minds any fourth dimension that direction and the sell-side have to collectively convince investors as to why the business actually needs to exist.

We find that absent of the Company's ownership of numerous different websites - which nosotros'll go to - at that place is zilch backing the Visitor's alleged "moat." In fact, the Company's capitalized software development per dollar of revenue is but a fraction of its peers. Note that the Company includes Caliber Technology (formerly Coupons.com) and Rocket Fuel Inc. in its proxy argument as peers.

(Source: author via public company filings)

Notation above that with respect to Rocket Fuel, the company doesn't break out software vs. other capex such as purchases of new role furniture. Nonetheless, the company does disclose components of PP&Eastward, which we utilize to estimate capitalized software development costs, as shown below. Given the consistent range from 59% to 85%, we see a 75% figure as fair and utilize information technology in the table higher up.

(Source: writer via public company filings)

Thus, nosotros detect that reverse to the "management's assertions," QuinStreet'southward business organization model is relatively simple. Information technology owns a bunch of websites from which it generates leads of consumers presumably looking to purchase goods or services (insurance, mortgage, credit cards, for-profit education, etc.). It so sells these leads to insurance companies and others, presumably looking to sell insurance to these customers. A list of the Company's top websites (per BuiltWith) is shown below.

Rank Domain 1 nextinsure.com 2 webopedia.com three insure.com 4 quinstreet.com five surehits.com vi coin-rates.com 7 improvementcenter.com 8 insurance.com ix hsh.com 10 eweek.com xi formfetch.com 12 unitedhomeimprovement.com xiii worldwidelearn.com 14 oldhouseweb.com 15 guidetolenders.com 16 codeguru.com 17 selfhelpforums.com xviii citytowninfo.com nineteen armystudyguide.com 20 developer.com 21 carinsurance.com 22 financerequests.com 23 repair-habitation.com 24 baselinemag.com 25 practicallynetworked.com

(Source: BuiltWith)

These leads include a name, phone number, and possibly other relevant information such as an accost, age, weight, height, etc. Later a customer fills out a form on one of AWL's sites, an AWL agent will confirm it via a call to the client, the process known as "qualifying." Information technology is then bundled with others and sold in a package.

This model is expert and well assuming that (1) leads are qualified, (ii) leads are acquired in an honest mode, (3) leads provide sufficient returns for buyers, and (4) the price that QNST acquires leads at provides sufficient margin such that the Company generates cash flow. We believe that QuinStreet's model is wholly impossible of satisfying each of these conditions.

QuinStreet's Partners are Overwhelmingly Deceptive

All Web Leads (AWL)

In February 2016, QuinStreet announced an sectional 10-year partnership with All Spider web Leads (AWL) "to exist the exclusive provider of click product technologies and management to AWL." AWL refers to itself as "the premier Customer Conquering Marketing business focused on the U.S. insurance industry." QuinStreet seemed specially excited about the partnership,

We are proud to partner with AWL and their excellent direction team," commented Doug Valenti, QuinStreet CEO. "Together, nosotros bring the largest media network and broadest ready of best-in-class customer acquisition products, technologies, and services to the insurance industry. Nosotros intend to leverage those combined capabilities into better consumer experiences, customer results, and online channel growth.

QuinStreet'south press release claimed of AWL that,

The visitor delivers real-time, targeted, loftier-quality consumers to peak insurance producers. AWL's applied science-driven approach to online marketing helps bring together agents with qualified customers who are actively searching online for insurance products. The company'southward honor-winning insurance leads, calls and clicks programs atomic number 82 the industry in conversion, qualification and book co-ordinate to recent surveys.

We believe that due to the click-based nature of the products and the timing of the partnerships, the AWL partnership has formed the foundation of the Company's "new click platform" that has been responsible for such tremendous growth.

We are pleased with the progress of the All Web Leads partnership. While its ramp has been somewhat slower than they or we expected due to difficulties and complexities associated with the integration of their acquired insuranceQuotes business organisation, it is already contributing significant new revenue and creating new opportunities for both companies to better serve clients and abound revenue together. Our enthusiasm and expectations for the partnership'southward potential are stronger than always.

On the Q4 2016 call management fifty-fifty stated,

give thanks goodness considering with the loss of teaching leverage, the big climb in insurance margins enabled past the new products that has really allowed united states of america to go along to invest but too to maintain and to brainstorm to expand profitability as that acquirement has come up.

And in the Q4 2017 telephone call,

Improved results are beingness driven past positive momentum from the products and media strategies and margin comeback efforts of the past couple of years and by our Financial Services and habitation services client verticals, which now account for over 70% of company revenue.

So how does All Web Leads operate? If we dig into AWL's history, we find that in Nov 2015, All Web Leads acquired insuranceQuotes.com, Bankrate's insurance division. Bankrate wasn't exactly a stellar business.

(Source: Google Finance)

This was due primarily to the fact that merely as nosotros believe of QuinStreet's business, Bankrate'southward business concern was incapable of both generating quality leads and generating cash flow. A 2012 complaint confronting the company states,

This scheme came to light only subsequently the company missed earnings expectations; the scheme could merely terminal so long before customers churned,

The SEC also plant that Bankrate had booked groundless acquirement.

Every bit was earlier noted, this has been turned into a multi-year ordeal for Bankrate, whose executives still face charges.

Even so, All Spider web Leads now owns this same insurance business concern. While both AWL and QuinStreet volition claim that the business has been "cleaned upwardly" since purchase, we fail to see evidence that this is the instance. In fact, we believe that nether private ownership, this business organization has been allowed to rely on increasingly dubious tactics to bulldoze business concern. So how does AWL generate leads? We believe one way is through the illegal tactic of "cybersquatting." Per the Anticybersquatting Consumer Protection Act (ACPA), information technology is illegal to

register, traffick in, or using a domain name confusingly similar to, or dilutive of, a trademark or personal proper noun.

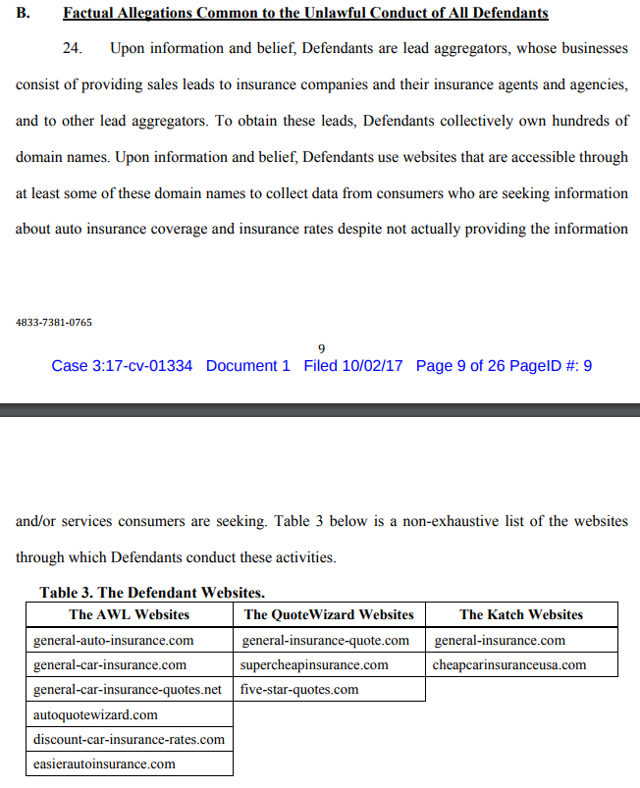

In fact, AWL is being sued by The Full general Automobile Insurance for alleged cyber-squatting and patent infringement. As shown in the complaint, AWL owns a variety of websites that mimic The General'south websites. Notation that this certificate was filed equally recently every bit October of 2017.

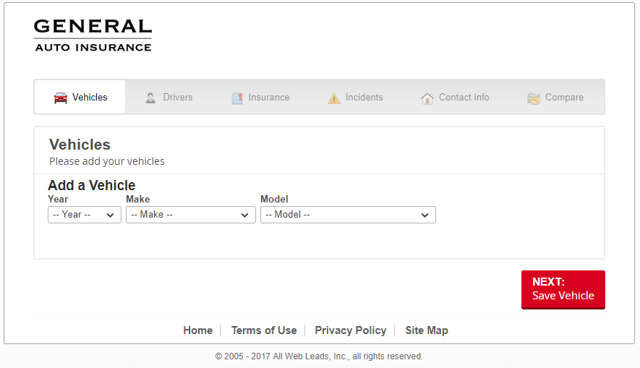

Nosotros tested these claims. As shown below, if we proceed to www.full general-auto-insurance.com and enter a nix code, the page redirects to the following, with "General Auto Insurance" conspicuously displayed and clearly intended to deceive the user into believing that he is working with the bodily named insurance company rather than a lead generator.

(Source)

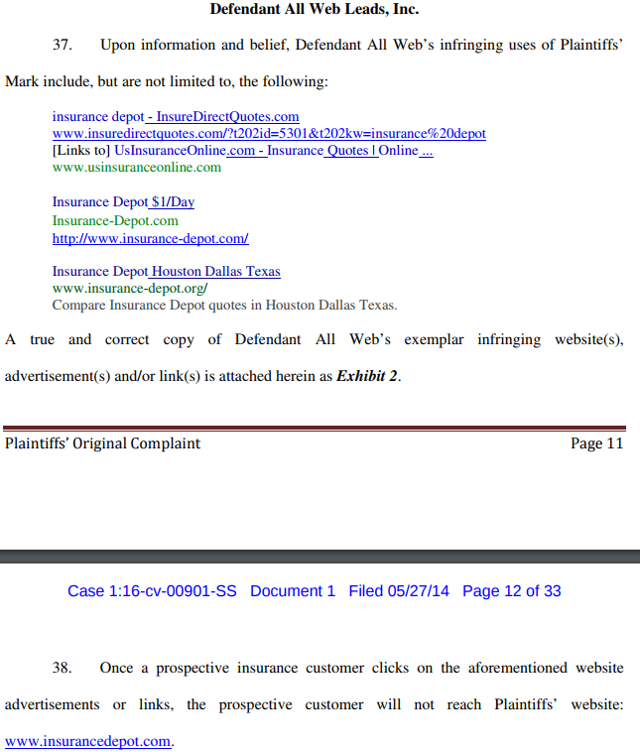

AWL was also sued by The Insurance Depot for like policies (subscription required). See below,

Every bit it turns out, insurance companies really don't like information technology when you lot pose as them in society to sell their own potential customers back to them.

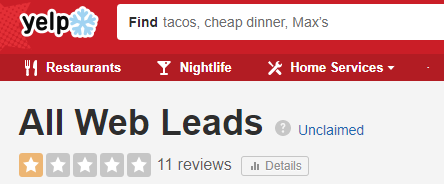

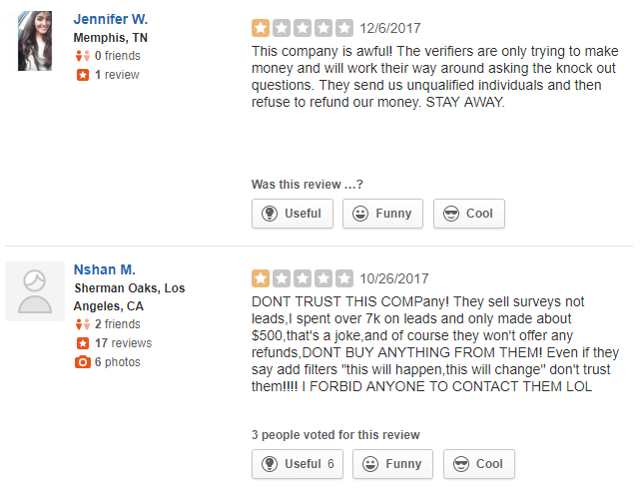

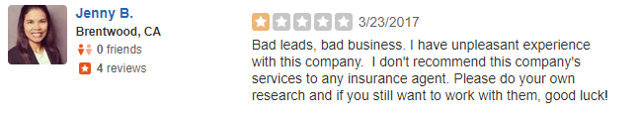

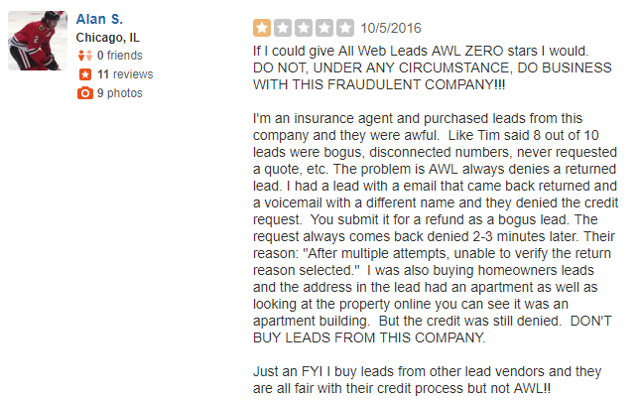

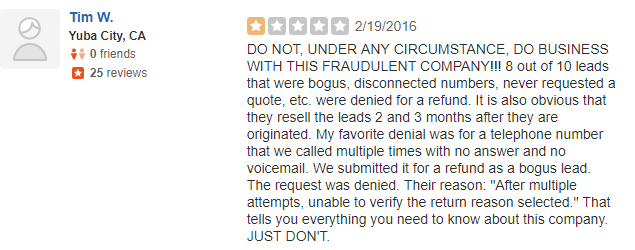

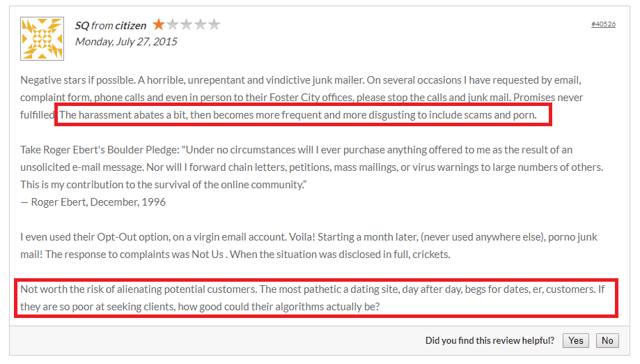

Customer reviews from insurance agents and other who have purchased leads from AWL/QuinStreet are far from kind. Meet the following from Yelp! ... Notation that we are not hand-picking these reviews; as of our fourth dimension of access, AWL has 11 reviews and every unmarried person has rated it only ane star. Again, note the dates that are as recent as Dec 2017.

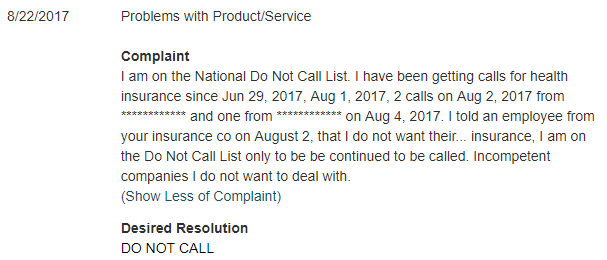

The Better Business Agency has a total of 142 complaints on AWL, and each 1 of the reviews provided are negative. Though lengthy, we provide a selection of recent complaints below. Again, we're not hand picking; we encourage investors to visit the site themselves and compare.

Better Business concern Bureau reviews as well reveal that buyers aren't the merely ones being deceived, just that "potential customers" are bombarded with calls confronting their will. The complaints also indicate that these leads may exist being sold to far more than than ii buyers, with one person claiming over twenty telephone calls in less than 12 hours.

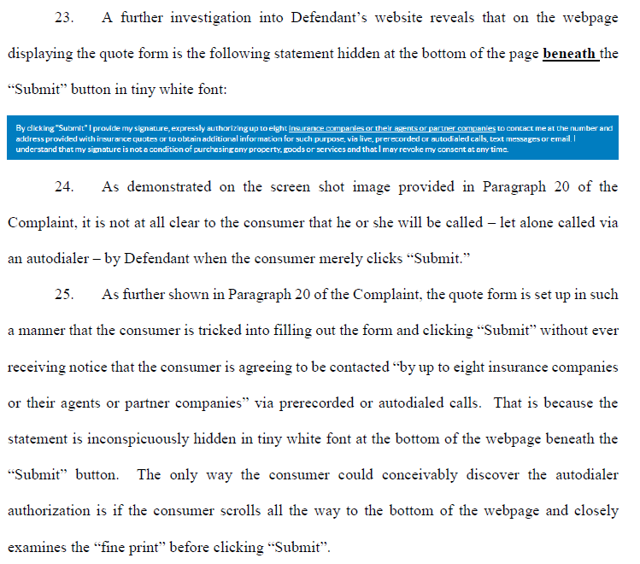

Additionally, we discover that AWL'due south own fine print disclosures permit the auction of leads to "upwardly to eight insurance companies or their agents or partner companies" as a February 2017 lawsuit against All Spider web Leads will show,

This language can besides be found in whatsoever of the numerous websites equally shown in our Google search below.

As product in QuinStreet or AWL's case just takes the form of customer data (i.east. intangibles), the Company could theoretically be selling multiple times over with zero impact to costs, hence bolstering profitability, at to the lowest degree in the short term. Notwithstanding, we believe investors ought to question just how long this tin can last, especially given Bankrate'south previous fate.

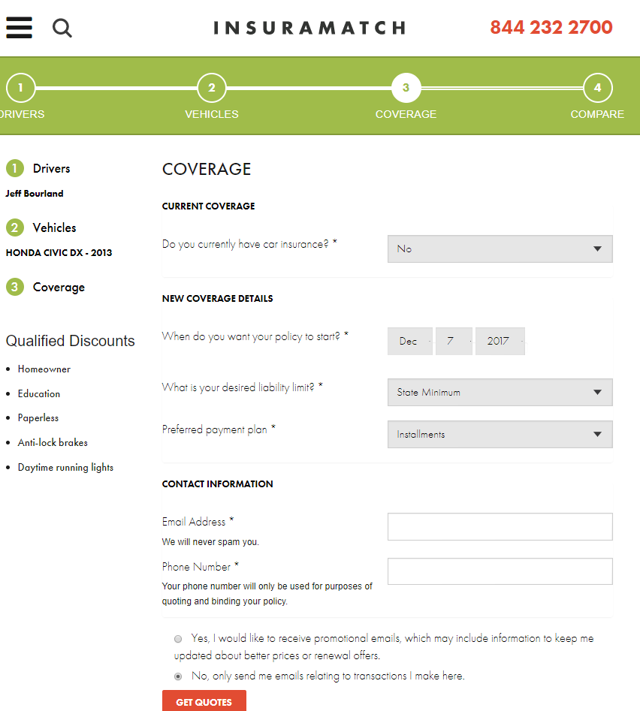

InsuraMatch

On May 3, 2017, InsuraMatch announced information technology had entered into

a series of agreements with QuinStreet whereby it will serve as QuinStreet's national agency sales and fulfillment center and acquire the QuinStreet Insurance Agency Sales Center, located in Altamonte Springs, Florida.

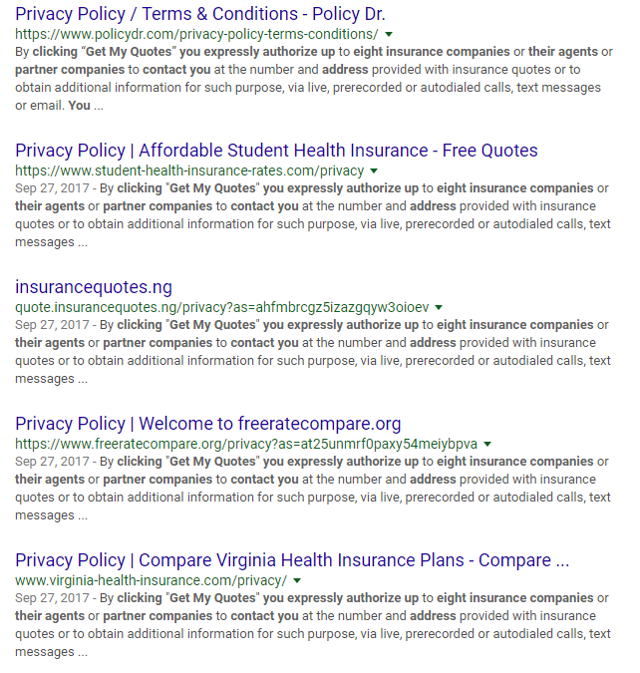

Note that the partnership announcement is conspicuously missing from QuinStreet's press releases. We believe that this is not accidental, merely that QuinStreet is becoming reluctant to let investors onto the true sources of its contempo growth.

(Source: QuinStreet press releases)

Yet, per InsuraMatch's press release, CEO Doug Valenti was once more clearly happy with the partnership's potential,

"This is a big win-win," said Doug Valenti, CEO of QuinStreet. "Through this partnership, we will add InsuraMatch'southward world grade Bureau Sales Center operations to our business mix. We expect greater yield and productivity from that area equally a outcome. This will also let usa to keep our focus on efforts and investments in our industry-leading rates and performance marketing products and technologies, the key drivers of competitive advantage and growth in our Insurance business concern."

Per InsuraMatch'south website,

InsuraMatch was created to help you lot make ameliorate, more confident decisions about your insurance.

We understand that insurance is non a one-size-fits-all type of product, then we tailor our recommendations to y'all and your needs. Whether y'all're searching for automobile insurance, homeowners insurance or fifty-fifty toy insurance, we're hither to aid you find insurance you dear - your InsuraMatch.

We surveyed thousands of current customers of dozens of top insurance companies to sympathize why they chose and what they valued about their insurance carriers. This huge database of data helps us help you pick a carrier that not but meets your protection needs, merely also your lifestyle.

Importantly, InsuraMatch is an independent agent. Nosotros stand for many slap-up insurance companies and offer you multiple insurance quotes when you shop with u.s.a.. For our automobile insurance customers, our proprietary friction match algorithm based on our enquiry will match you with the carrier that'due south correct for you.

And then, how exactly does InsuraMatch piece of work? We once more tested the site ourselves to find out (annotation nosotros are non Jeff Bourland). We were able to keep through the entire procedure past entering a proper name, contact information, owner information such as occupation, marital status, commute distance, and more.

(Source: Insuramatch.com)

Upon clicking "become quotes" at the bottom of the grade, nosotros were redirected to the following page. Note that at that place were no links provided to annals for insurance with the listed carriers, just a contact number that directs back to InsuraMatch.

Though the quality of these leads may exist slightly higher due to college demonstrated customer intent, the platform remains highly deceptive, as it leads the user to believe that he or she will actually receive bindable quotes on the spot rather than having to call InsuraMatch'due south number. InsuraMatch has also been sued for TCPA violations equally the Company placed calls using an auto-dialer.

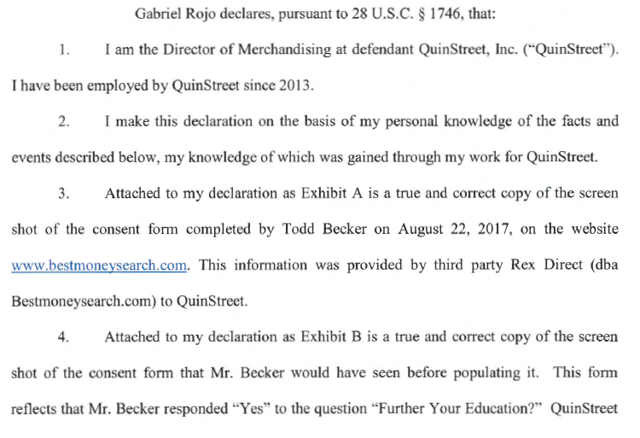

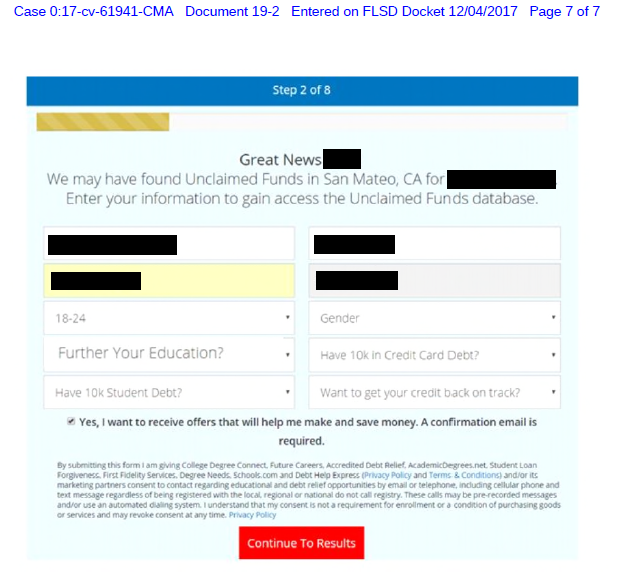

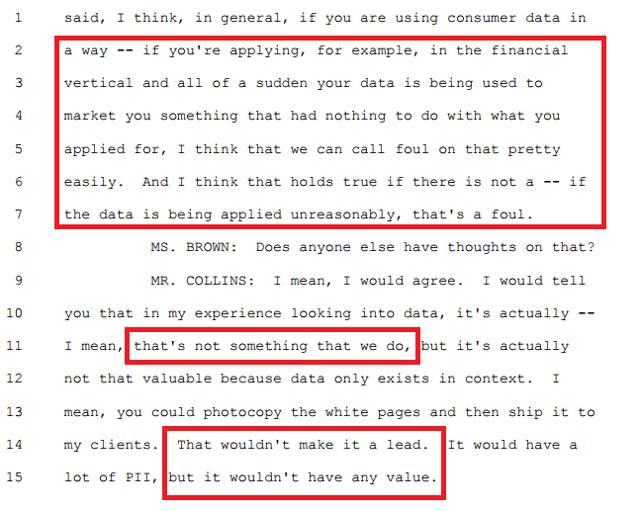

Not only as demonstrated through the Company's partnerships with All Web Leads and InsuraMatch, but in a suit brought by Todd Becker, testimony from QuinStreet's own Director of Merchandising indicates that the Company is aware of these tactics. Annotation that the following was entered into the court docket as recently every bit Dec 4, 2017,

Equally Showroom B shows, www.bestmoneysearch.com claims to have "found unclaimed funds" for the user, inducing him to enter contact information in guild to "gain admission."

Nevertheless, the fine print shows that the form has nothing to do with unclaimed funds, but is a ploy to obtain information that will be sold to "marketing partners" who will contact in regards to "educational and debt relief opportunities."

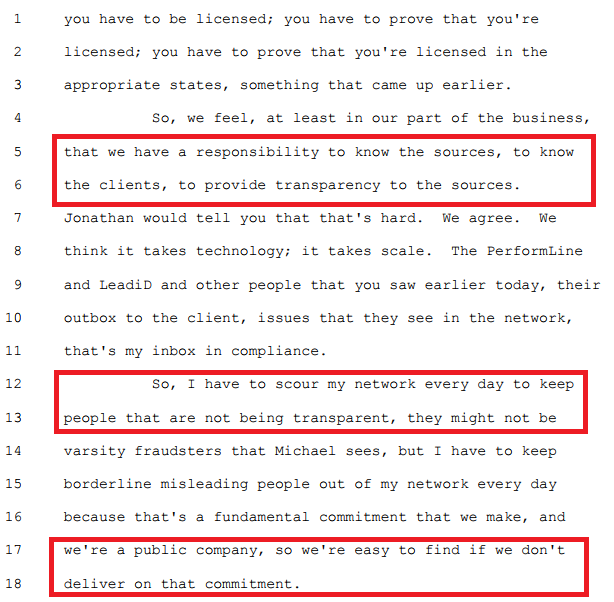

Notably, in an October 2015 FTC workshop on lead generation, QuinStreet's SVP Corporate Development, Legal & Compliance; GC (per LinkedIn) Marty Collins explicitly stated that the Company doesn't engage in this behavior, reverse to the Company's own disclosure.

Collins notes that "That wouldn't make it a lead" and that "it wouldn't have whatever value." Nosotros don't even have to show that the Company isn't providing value to its customers; its own general counsel is doing it for united states!

Collins notes that "That wouldn't make it a lead" and that "it wouldn't have whatever value." Nosotros don't even have to show that the Company isn't providing value to its customers; its own general counsel is doing it for united states!

The Becker complaint also indicates that the visitor is not simply bombarding its customers with phone calls, but spoofed texts. Again, in our view, these constitute blatant TCPA violations.

In the aforementioned transcript, Collins also noted that the Company has "a responsibility to know the sources" ... "to scour my network every twenty-four hour period" ... and notably allow on that as a public company, "nosotros're easy to discover if we don't deliver on that commitment."

On that front, the Company claims to reject/filter out partner sites that contain pornography,

On that front, the Company claims to reject/filter out partner sites that contain pornography,

Publisher Sites. Publisher Sites shall not promote, contain or link to whatsoever destination that includes, contains or promotes (i) pornographic, obscene, libelous or offensive material, (two) software trading, hacking or phreaking content, ((iii)) unauthorized audio or video reproduction, downloads or content, (iv) any spyware, adware, trojans, viruses, worms, spybots, keyloggers or any other form of malware, or (five) whatever illegal content.

All the same, this runs opposite to the review of QuinStreet that we found on a deject business review website. Annotation that we are unaware whether the review refers to a QuinStreet-owned site or a partner site.

Nevertheless, Barrington Inquiry's November 2017 initiation on the Company states that "the largest share of revenues comes through partner sites, which take on the cost of driving traffic to their own sites." Given that this is the instance, we believe investors ought to consider the long-term effects of QuinStreet'south apparent lack of discretion regarding who it chooses equally a partner.

Nevertheless, Barrington Inquiry's November 2017 initiation on the Company states that "the largest share of revenues comes through partner sites, which take on the cost of driving traffic to their own sites." Given that this is the instance, we believe investors ought to consider the long-term effects of QuinStreet'south apparent lack of discretion regarding who it chooses equally a partner.

Not only are partners' sites overwhelmingly deceptive, only so are QuinStreet'south

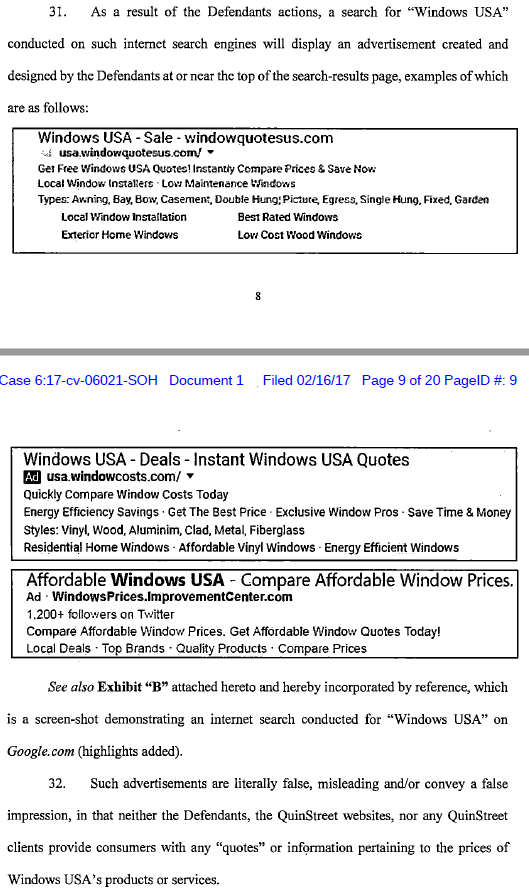

In February 2017, QuinStreet was sued by Windows USA, LLC, a manufacturer and retailer of premium vinyl windows and doors (would exist classified under QNST's Domicile Services / other vertical). The complaint alleges that QuinStreet has posed as the company through websites such equally www.windowcosts.com, world wide web.windowquotesus.com, and world wide web.improvementcenter.com.

Again, we believe this is a relatively articulate cut case of cyber-squatting, this time not merely by QuinStreet's partners, merely past the Company itself.

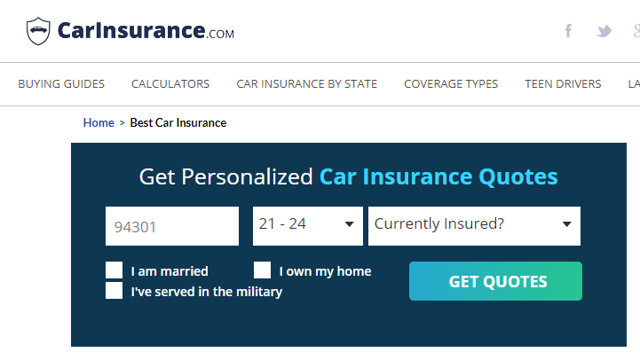

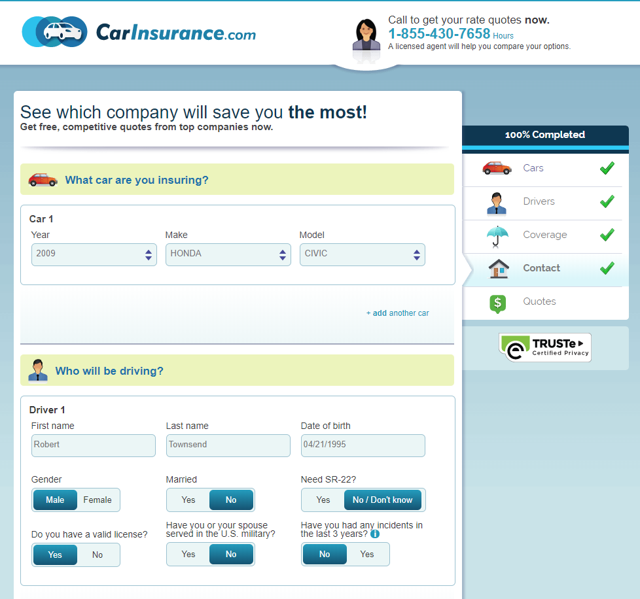

We explored CarInsurance.com, another one of QuinStreet's company-endemic sites in an effort to receive "personalized car insurance quotes" as offered below.

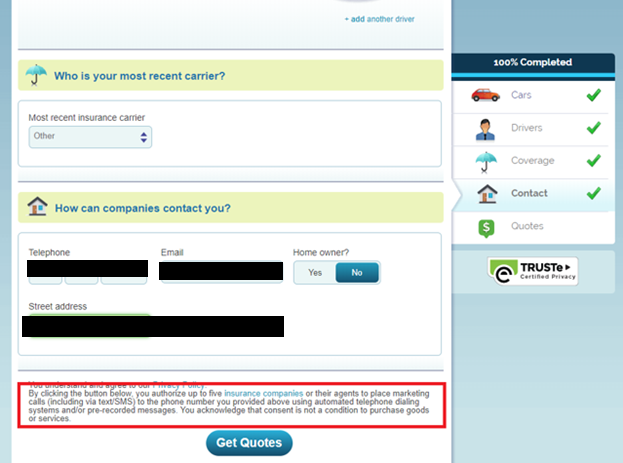

Nosotros proceeded through the procedure, entering information for a 2009 Honda Civic (annotation we are not Robert Townsend). As shown, the Company site states in fine print "By clicking the button below, yous authorize upwardly to five insurance companies or their agents to place marketing calls (including via text/SMS) to the phone number you lot provided above using automated telephone dialing systems and/or pre-recorded messages."

Nosotros proceeded through the procedure, entering information for a 2009 Honda Civic (annotation we are not Robert Townsend). As shown, the Company site states in fine print "By clicking the button below, yous authorize upwardly to five insurance companies or their agents to place marketing calls (including via text/SMS) to the phone number you lot provided above using automated telephone dialing systems and/or pre-recorded messages."

Note that just as AWL's language stated "upwards to eight insurance companies" could be given the leads information, QuinStreet'south own language permits up to five insurance companies to identify marketing calls. We struggle to reconcile this with the 2 times that is quoted to lead buyers.

Upon clicking "Get Quotes," we were redirected to the following page, which didn't offering quotes as advertised, but stated that we would be contacted from "top companies." Upon clicking whatever of the "Get Quote" links in orangish on the right side of the page, we were only redirected to re-enter data with the respective companies.

We notice this to be a highly deceptive exercise wherein potential customers seeking online quotes then have their information sold to multiple insurance carriers who have the ability to bombard the client with calls, texts, and emails.

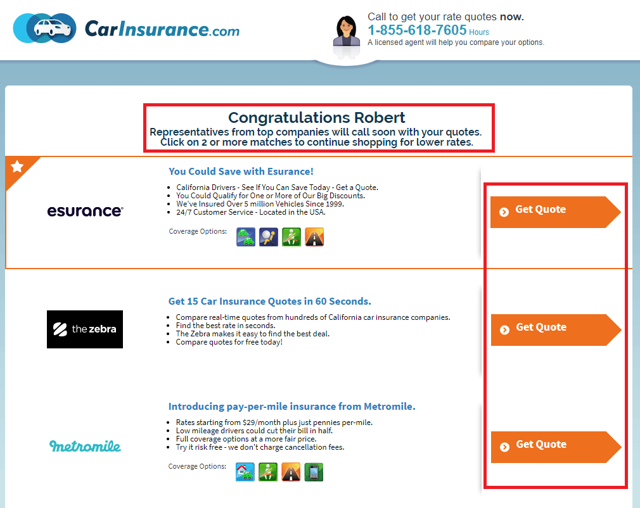

Indeed, as shown in the previous complaint, Becker was bombarded not only by "third party Rex Straight" only past campuscorner.com, which is owned and operated past QuinStreet.

Elsewhere, Stuart Abramson brought a class action lawsuit filed December 2016 against QuinStreet for intrusive, nuisance telemarketing practices. In fact, Abramson sued the incorrect people at get-go, as we believe the telemarketers who were in fact from QuinStreet claimed to be from Travelers Insurance. The visitor was using robocalls and obscuring the true telephone number, which is illegal. Notation that INSURE.com is QuinStreet's third largest website, per BuiltWith.

Abramson'south accommodate demanded all members of the class would be entitled to up to $ane,500 per telephone call or text for willful and knowing violations.

Abramson'south accommodate demanded all members of the class would be entitled to up to $ane,500 per telephone call or text for willful and knowing violations.

Dennis Debusk also filed a class activeness suit against the Company in April 2017. Note that QuinStreet's own INSURE.com was again the culprit.

Debusk is seeking minimum damages of $500 per call. Even so, note that these minimums are only if the defendant was "unknowingly" making these violations. Should the court make up one's mind that these were willful and knowing, the fine over again goes to $1,500 per violation.

Though we could likely go on for days with these examples, we believe its suffice to say that these practices have get fundamental to QuinStreet's business model. Interested readers can access a full listing of registered @quinstreet.com domains here.

Our research has uncovered numerous other telephone numbers that QuinStreet uses to spoof those being called and obscure its identity. For example, run across the following complaints about one-855-494-0963.

Again, we'd expect that these tactics would lead to tremendous customer churn. Notwithstanding, in club to get-go this churn, the Company has a render policy which will refund customers for bad leads. Per the Company'south client terms,

(1) Except as otherwise set along herein, QS will simply take the return of a Atomic number 82 delivered to Customer that (A) fails to contain the Lead Criteria; (B) is a duplicate atomic number 82 (defined as a lead sent more than one time by QS to Client inside the past xxx agenda days); (C) contains clearly false information (eastward.thou., Mickey Mouse, Santa Clause, etc.); or (D) contains a disconnected telephone number or fax number (on both primary and alternate numbers, if provided) AND contains an invalid e-mail address (i.e., bounces back). However the foregoing, Leads with which Client has established a contact shall in all cases be considered valid. Unless otherwise set along in an IO, Warm Transfer Leads and DTSP Leads are not field of study to return.

(2) Client shall submit credit requests for invalid leads via the Client Services interface or other method specified by QS. Returned leads must include the reason for the render, all data originally sent by QS to Client, and whatsoever other data reasonably requested by QS. Unless otherwise QS Approved, Client must submit all credit requests for invalid leads within five (5) business days of delivery to Client and QS will not have the return of whatsoever delivered leads following that date. If QS reasonably confirms the returned Lead is invalid, QS will credit the advisable amount to Client.

Given the quality of leads QuinStreet generates, we detect this return policy unduly stringent. Notably missing from these terms are refunds for leads that (1) have been sold to multiple customers, (2) leads that are "stale" and (3) leads that were obtained via ACPA or TCPA violations, all of which we believe have been meaning drivers of QuinStreet's business.

Nosotros believe that the Company'south tremendous amount of bad leads sold to customers has led to increases in "non-standard revenue credits" as customers forcefulness the Company to refund previous payments in the form of future leads. Manifestly, there are so many of these credits that the Company couldn't even relay them through the proper channels.

Well-nigh recently, as described in Item 9A in Part Ii of this Annual Report on Course 10-K, equally of June 30, 2017, we disclosed a cloth weakness in internal command over fiscal reporting over the completeness and accuracy of the bookkeeping for non-standard acquirement credits. Specifically, our internal controls did not place non-standard revenue credits authorized but not timely communicated to finance to ensure proper bookkeeping evaluation. Equally a result, during the quaternary quarter of 2017, we identified a non-standard revenue credit that was non accounted for in the correct period.

Nosotros did not maintain constructive internal control over financial reporting over the completeness and accuracy of the accounting for non-standard revenue credits. Specifically, our internal controls did non identify non-standard revenue credits authorized only not timely communicated to finance to ensure proper accounting evaluation. Every bit a event, during the fourth quarter of 2017, we identified a not-standard revenue credit that was not accounted for in the correct menstruum.

In fact, nosotros believe that the Company's identified weakness in Internal Controls related to non-standard revenue credits is the canary in the coal mine. Notably, though the Company has had this "not-standard acquirement credit" policy in years past, 2017 was the first year in which the Company identified a weakness in internal controls due to their use.

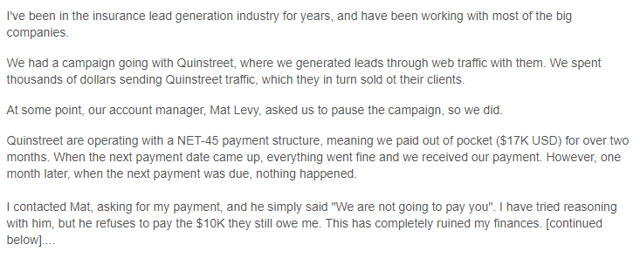

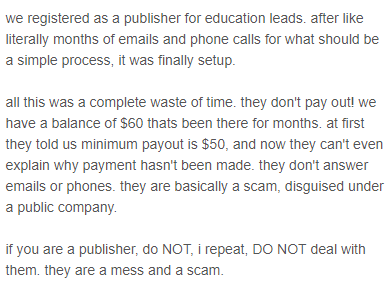

Our research indicates that QuinStreet'due south increased profitability could likewise be due to its failure to pay partners (suppliers) for leads

As was the example with All Web Leads and InsuraMatch, QuinStreet allows individuals to partner with the Company to supply leads which QuinStreet then re-sells. These purchases are made through a different company-owned entities or websites such every bit Surehits.com or QuinStreet Publishers. Our understanding is that the programme effectively allows anyone with a website to become a QuinStreet supplier. The Company claims to restrict publishers from cloaking/cyber squatting, contrary to what nosotros have already seen from other partners and the Visitor's own websites.

Publisher volition not (i) provide any class of incentives or compensation to generate Traffic under this Understanding, (ii) use or engage in any false impression, email spamming or search engine "spamming" (i.e., the inappropriate use of search engine optimization tactics such as doorway pages or cloaking)

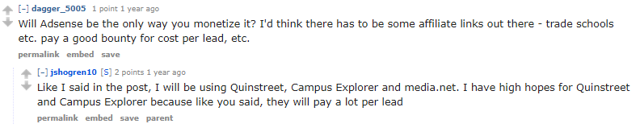

See a Reddit post in which a user purchases a website with the purpose of selling leads and re-directing visitors to QuinStreet. See a screenshot of the user'due south website beneath.

(Source: Reddit)

The user noted in a comment that QuinStreet tends to "pay a lot per lead" which induces independent partners to cull QuinStreet over other atomic number 82 buyers.

However, when information technology comes to actually paying suppliers properly for these leads, QuinStreet's reputation is far from robust. See the following complaint from Ripoff Report posted every bit recently as November 29, 2017,

And the post-obit from the same review site,

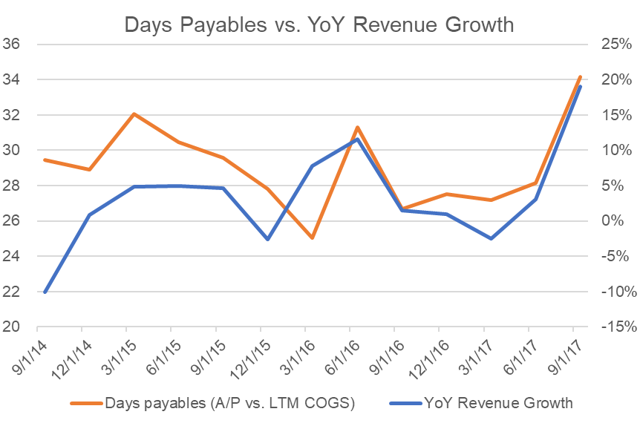

Every bit it turns out, the Company's yr over year acquirement growth is strongly correlated to its days payables, and the Visitor'south recent growth has been accommodated by the highest level of days payable the Company has seen since 2009.

(Source: author via public company filings)

We believe investors ought to consider the sustainability of these practices and payment policies and thus what this may suggest for the Visitor's future growth prospects.

The Company claims that temporary reinvestment has merely temporarily depressed margins; we believe this is false; it'south a structural shift in the business concern model as the prior model came nether intense scrutiny.

The Company'south most recent 10-Q states that,

The increase in gross margin was primarily attributable to decreased personnel costs and decreased amortization of intangible assets, partially offset by a college proportion of our revenue coming from our fiscal services client vertical, which tend to take higher media and marketing costs as a percent of revenue.

Translated, the Company has to pay Google more than for each click in the more competitive insurance vertical than information technology does in other verticals. Given that an increasing portion of the Company'south revenues are generated from the vertical, we see this shift every bit structural to the concern rather than anything one-time in nature. Nevertheless, management has been spinning the aforementioned story for the past iii years.

August 12, 2014,

Performance marketing is a big and important opportunity. We are seeing good success in our initiatives to diversify and expand our media, products and client footprint. We are also seeing growing interest in success from customer and media partners alike. Our investments in new initiatives are working and are key to returning the business concern to yr-over-twelvemonth growth. Margins will re-expand with the return of top line growth and as we wind down this heavy investment period.

October 30, 2014,

Overall, we have reached a turning point where we now expect revenue growth in Fiscal Services and Other Client Verticals and from new initiatives in Education to offset decreases in revenue from for-profit schools in our overall results. This is a big bargain. It's what we've been working toward, and it means that nosotros are at present entering a period where we expect overall acquirement to exist generally up and to the right again versus the declines over the by few years. We besides wait that adjusted EBITDA margins will begin to re-aggrandize with top line leverage and as we move from heavy investments in growth to optimization.

May 5, 2015,

Turning to our outlook for the June or current quarter. Nosotros expect to grow acquirement yr-over-year in each of our client verticals, Education, Financial Services and Other, for the first time in over 3 years. Total acquirement growth should exist about five%. Adapted EBITDA margin is expected to be in the low single digits, as we will keep to invest aggressively in the strong progress of our growth initiatives.

We will continue to invest in our growth and diversification initiatives, as these investments are working. We wait that adjusted EBITDA margin will reexpand over fourth dimension through tiptop line leverage.

February ix, 2016,

In summary, the second quarter marked an important step in our progress to diversify and reinvigorate our business. Over the past few years nosotros have worked to broaden and enhance our product set, resulting in increased media yield and better quality results for both consumers and clients. We have expanded our media footprint to reduce reliance on search engines and affiliates and have successfully penetrated new markets such as non-for-profit schools and international, particularly Brazil.

August 9, 2016,

Equally far as margin goes, the investment menstruation in the insurance really ended about a year ago, which was the bottom of our margins in insurance. Our insurance margins today are upward on a variable basis - on a variable margin footing of near 5x where they were about a yr agone and are continuing to climb and are all very close to historic margins. When I say historic, I mean margins created a drop in our insurance business organisation a few years ago, and that's inclusive of the AWL deal, which is kind of right in line with kind of averages there. So we're - and thank goodness considering with the loss of didactics leverage, the big climb in insurance margins enabled past the new products that has really immune usa to continue to invest but also to maintain and to begin to expand profitability as that acquirement has come.

May 9, 2017,

We do not expect - we do expect to grow revenue but nosotros haven't completed the plan and so nosotros -- I tin't give you whatsoever indications of what we call up the charge per unit of that growth will be. Simply again, it sets upwards pretty nicely from a comparable standpoint and we practice non expect to meaningfully grow expenses or costs. So that should set united states of america up pretty well for EBITDA margin and EBITDA margin expansion next twelvemonth.

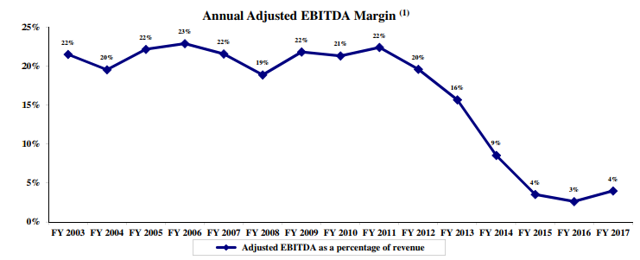

While "adjacent year'south" margin expansion has been the balderdash case for years, management has failed to deliver. In fact, results have materially worsened. Even if we accept the Company'south own (heavily) adjusted EBITDA margin, the results aren't pretty.

(Source: Visitor-produced chart)

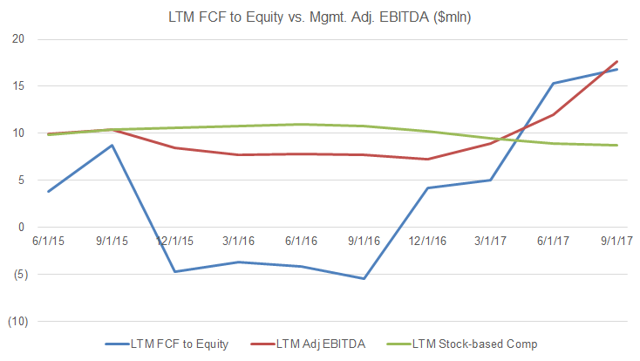

Notably, EBITDA historically didn't track with free cash flow, which has been negligible over the past few years. It is simply over the past few quarters that costless cash flow has seen comeback towards EBITDA. Further, the Company has LTM stock-based compensation of $8.9mln, or fifty% of LTM Adj. EBITDA.

(Source: author via public company filings)

There isn't much new to the story here; QuinStreet is Web 1.0 tech, and the Company's recent growth has come from towing the line. We believe that condone for the ACPA, the TCPA, and its customer base of operations is the simply promise the Visitor has, and is wholly unsustainable.

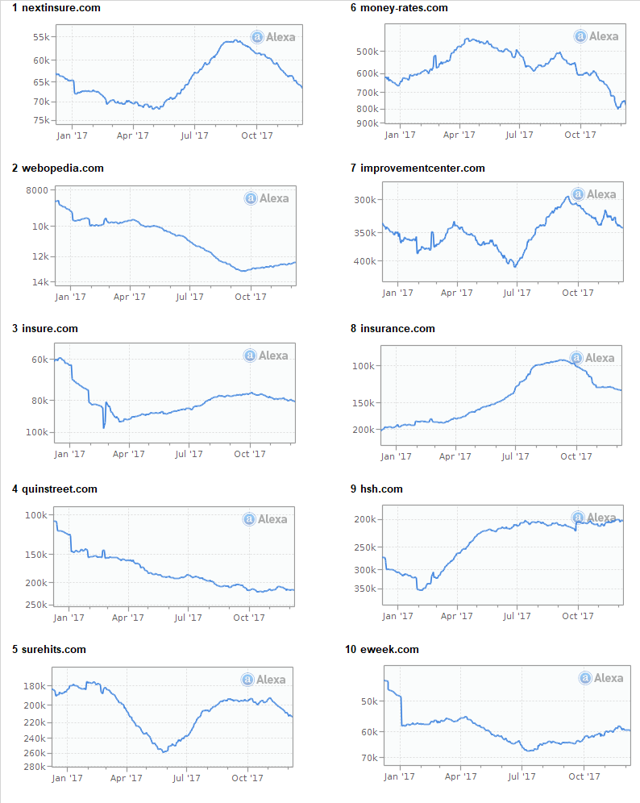

In fact, QuinStreet-owned website traffic data shows that traffic to the Visitor'south sites is already dropping off.

We pulled the list of QuinStreet'due south top 50 websites via BuiltWith. The full listing is below.

Rank Domain Rank Domain ane nextinsure.com 26 htmlgoodies.com two webopedia.com 27 campuscorner.com 3 insure.com 28 esecurityplanet.com iv quinstreet.com 29 allpsychologycareers.com 5 surehits.com 30 javascriptsource.com 6 coin-rates.com 31 schools.com 7 improvementcenter.com 32 windrivers.com 8 insurance.com 33 searchschoolsnetwork.com 9 hsh.com 34 virtualdr.com 10 eweek.com 35 selfhelpandmore.com eleven formfetch.com 36 wisepiggy.com 12 unitedhomeimprovement.com 37 webbuyersguide.com 13 worldwidelearn.com 38 medsave.com 14 oldhouseweb.com 39 bestrates.com 15 guidetolenders.com 40 reliableremodeler.com xvi codeguru.com 41 automechanicschools.com 17 selfhelpforums.com 42 bosleyconsultation.com eighteen citytowninfo.com 43 carpetbuyershandbook.com 19 armystudyguide.com 44 estudenaanhanguera.com twenty developer.com 45 antionline.com 21 carinsurance.com 46 allaroundthehome.com 22 financerequests.com 47 uofphx.info 23 repair-dwelling.com 48 leadpost.net 24 baselinemag.com 49 devx.com 25 practicallynetworked.com fifty databasejournal.com

Nosotros then cross-referenced the peak 10 sites above with Alexa traffic ranks. The results are telling. Every bit shown, sites experienced substantial ramps in rankings during Q4 and Q1, while rankings have since fallen markedly since October 2017. We don't believe that this bodes well for the Company's well-nigh-term results.

(Source: writer via Alexa Information)

We believe that the same methods are losing steam, and the Company may exist attempting to offset declines with malware-driven traffic.

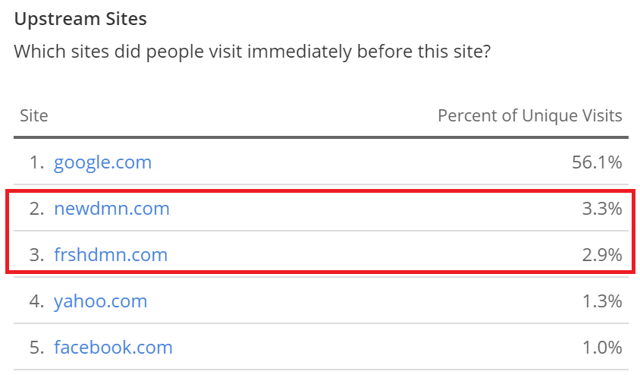

In examining sources of traffic to QuinStreet websites, we find the following for Insure.com (QuinStreet's #3 site, per BuiltWith) via Alexa. Note that outside of the site'south reliance on Google, "newdmn.com" and "frshdmn.com" are the adjacent highest traffic drivers.

(Source: Alexa)

Both of these sites seemed to have only popped up as recently as Nov 2017, yet are now ranked relatively highly.

For reference, Amazon updates the top i million websites daily, which can be accessed hither. Compare to these to more widely recognized sites such as the bbb.org which is currently ranked #4,848, Univision.com ranked #v,252, or collegehumor.com ranked #5,370.

(Source: Alexa)

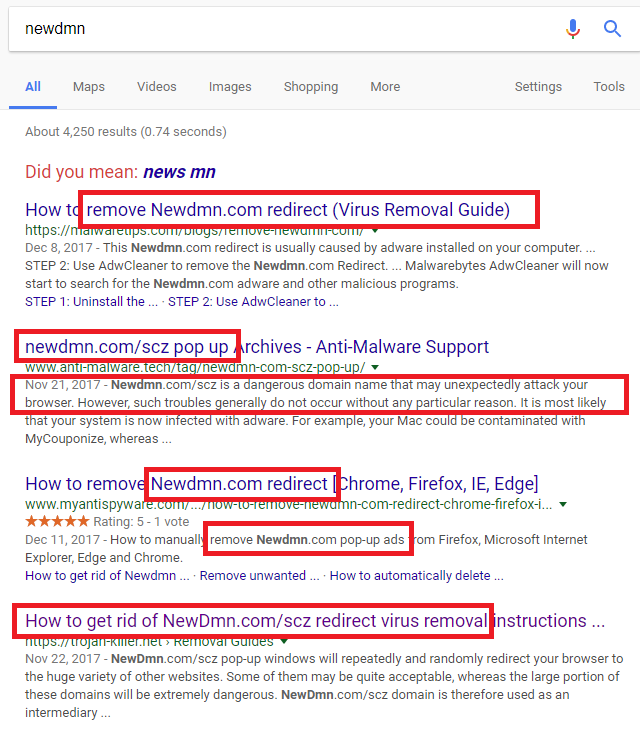

A elementary Google search reveals that newdmn appears to exist redirect malware, wherein pop-up windows redirect the user'due south browser to a different website than intended (in this case, QuinStreet'due south own Insure.com).

The same can be said for frshdmn.

(Source: Google, author annotation)

We find it highly questionable that these two sites are now the top contributors to Insure.com's traffic exterior of Google.

We believe that QuinStreet will ultimately be held responsible for its own actions and the actions of its partners. The FCC is increasingly cracking down on TCPA violations, including multiple 9-figure fines in the by 6 months lone.

The Company'south risks section states,

We depend on third-party publishers, including strategic partners, for a significant portion of our visitors. Any pass up in the supply of media available through these third-party publishers' websites or increase in the cost of this media could cause our revenue to decline or our cost to reach visitors to increase.

A pregnant portion of our acquirement is attributable to visitor traffic originating from third-party publishers (including strategic partners).

FCC Chairman has been taking the issue extremely seriously. In Pai's ain words,

Turning from process to substance, our March agenda is a full one. Every bit I said, the FCC volition be voting on six items. (One-pagers describing each of these items in greater detail will before long be made available on the Committee'southward website.) Topping the listing will be a proposal to gainsay the top source of consumer complaints to the FCC: robocalls.

We've all been there. You're eating dinner or in the middle of watching your favorite show and you're disturbed by the ring of a pre-recorded phone call. These calls are non just a nuisance; they're often scams. For instance, outlaw operators are posing every bit IRS agents and threatening people, particularly older Americans and other vulnerable populations, that if they don't send them money, law enforcement will come after them.

There are rules on the books prohibiting these unwanted calls, but scofflaws are finding artistic ways to avoid getting caught. When U.S. consumers are receiving 2.4 billion robocalls a month, we need to practice more than. And by "we," I mean the FCC, collaborating with the individual sector. I'one thousand grateful for the company leaders and consumer groups who teamed up in 2016 to course the Robocall Strike Force, which has been working to come up upwardly with solutions to this growing problem.

Ane of the issues the Job Force has singled out is caller ID spoofing. Through spoofing, someone calling from i number (555-1212) changes caller ID data to brand it appear as though he'southward calling from a unlike number (867-5309). Scammers and spammers employ spoofing to disguise their identity, to trick consumers into answering unwanted calls, and to hide from regime. And under the FCC's current rules, which generally prevent call-blocking, in that location is non much that carriers tin do to cease this.

This must change. Under my proposal, the FCC would give providers greater leeway to cake spoofed robocalls. Specifically, they could cake calls that purport to be from unassigned or invalid phone numbers (there'south a database that keeps runway of all phone numbers, and many of them aren't assigned to a vocalisation service provider or aren't otherwise in apply). At that place is no reason why any legitimate caller should be spoofing an unassigned or invalid telephone number. It'south just a way for scammers to evade the police force.

These new rules were adopted in November 2017, and enactment could tear apart what we believe is the foundation of QuinStreet's business.

Voice service providers are now expressly authorized to block robocalls that use those spoofing strategies as well equally those that appear to be from area codes that don't exist or from numbers that oasis't been assigned to a provider.

Non only is the FCC seeking to curb future FCPA violations, simply is heavily penalizing companies for previous actions,

In June 2017, DISH Network was fined a full of $341mln in two separate court actions for TCPA violations. The court found that,

Dish's reckless determination to apply anyone with a telephone call center without whatsoever vetting or meaningful supervision demonstrates a disregard for the consuming public.

Later on in June 2017, Adrian Abramovich was fined $120mln for a spoofed robocall entrada.

Abramovich made upwards caller identification to match the area code and first three digits of the recipients' phone numbers. When they answered, all the same, an automated message prompted them to "Press 1" to hear about "sectional" vacation deals from well-known travel companies like Marriott, Expedia, Hilton and TripAdvisor, co-ordinate to the FCC. Consumers who pressed the button were transferred to foreign call centers where alive operators attempted to sell the packages, which were non affiliated with the companies mentioned in the recorded message.

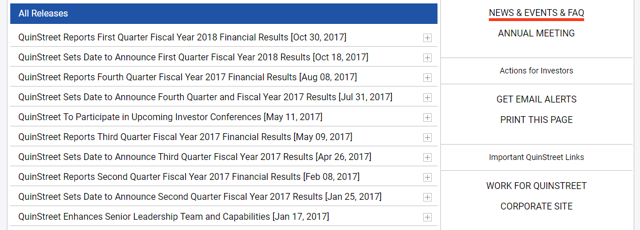

In August 2017, Philip Roesel, possessor of "Best Insurance Contracts" in North Carolina, was fined $82mln for illegal robocalls.

The FCC found that Best Insurance Contracts and its possessor/operator, Mr. Philip Roesel (doing concern as Wilmington Insurance Quotes) apparently made millions of illegally spoofed robocalls consumers effectually the state. Mr. Roesel of Wilmington, North Carolina displayed inaccurate caller ID information when making robocalls in an effort to sell wellness insurance, which specially targeted vulnerable consumers, including the elderly, the infirm, and low-income families.

Given the Company'due south and its partners' overwhelming use of robocalls and number spoofing, an FCC fine could create a residual canvas result. The Company might not exist prepared for this; see the risks section of the most recent class 10-K in which the Company discloses that its revolver has expired and not been renewed,

We may demand additional upper-case letter in the future to meet our financial obligations and to pursue our business objectives. Additional capital may not be available or may not be available on favorable terms and our business and financial status could therefore exist adversely affected.

In June 2017, our revolving loan facility expired. While we conceptualize that our existing greenbacks and cash equivalents and cash we expect to generate from time to come operations will exist sufficient to fund our operations for at least the next 12 months, we may demand to raise additional capital letter, including debt capital, to fund operations in the futurity or to finance acquisitions.

In addition to a fine, the FCC would likewise likely levy increased oversight on the Company, every bit is typically the case. Nosotros believe this would thus not only create a residue sheet event, but permanently impair whatever potential future cash menstruation generating power the Company has.

Absent the FCC, in that location are other cardinal reddish flags that could cause permanent business organization damage, namely customer concentration and reliance on Google.

Progressive accounted for 17% of revenues in the full yr 2017, and increased to 24% of revenues as of the quarter ended September xxx, 2017. Should Progressive somehow learn of QNST's deceptive tactics and / or take a greater focus on true ROI generation from the source, the Company would lose a substantial portion of business organization. Additionally, insurers are increasingly conducting QuinStreet's business themselves by bidding on AdWords, decreasing their reliance on the Visitor. Given the suit betwixt All Web Leads and The Full general, this doesn't bode well for the Company'due south relationship with insurers.

Additionally, high reliance on Google/search traffic to drive atomic number 82 generation could bear witness detrimental to the business should Google make a simple algorithm change. SimilarWeb information provides percent of traffic originating via search for each site, and we query this data with a focus on QuinStreet's peak Financial Services related sites, equally this vertical has been driving results. The results are below.

Domain Search-driven Traffic webopedia.com 90.1% insure.com 56.8% money-rates.com 69.five% improvementcenter.com 36.1% insurance.com 63.eight% hsh.com 69.8% eweek.com 46.4% carinsurance.com 91.viii% campuscorner.com 93.0% webbuyersguide.com 83.9% medsave.com 52.6% bestrates.com 78.7% Median 69.seven% Mean 69.4%

(Source: author via SimilarWeb data)

Equally shown, these sites rely substantially on Google for traffic. Nosotros leave readers to come to their own conclusions regarding the remainder of QuinStreet's backdrop. Even so, as the Company admits "a substantial share" of traffic to QuinStreet and its partners' internet properties originates via Google searches, whatever change in algorithms or an agin action from Google could impair the business.

Google makes regular updates to its algorithms, with the well-nigh recent "Fred" update in March 2017 notably targeting "low-quality posts,"

targeting websites that violate Google'due south webmaster guidelines. The majority of affected sites are blogs with depression-quality posts that appear to be created generally for the purpose of generating ad revenue."

This isn't the starting time time a business would be adversely impacted past a Google algorithm alter, with peers such as Need Media and RetailMeNot having been affected in the past,

Need Media has sold off a number of its hallmark properties in contempo years as part of an effort to distance itself from its reputation as a content farm ... later Google recalibrated its search engine formula in 2011 to partly decline inexpensive content, Need Media's market capitalization shrunk dramatically, from more than $2 billion to near $117 million today."

From a May 2014 Motley Fool article aptly titled "How Ane Google Algorithm Update Can Kill A Business concern,"

Final week, shares of RetailMeNot (Sale) slid over 20% over the form of two days after a report from SearchMetrics found that the website's visibility had fallen 33% on Google's search engine. The turn down came subsequently Google released an update to its search algorithm, dubbed Panda 4.0. Considering that RetailMeNot receives approximately 65% of its traffic from search engines, this could exist a huge blow to the number of people clicking on its coupon codes.

The Company recognizes this in its risks section,

Our ability to maintain or grow the number of visitors to our owned and operated and our 3rd-party publishers' websites from search companies is not entirely within our control. Search companies frequently revise their algorithms and changes in their algorithms have in the past caused, and could in the hereafter cause, our owned and operated and our third-party publishers' websites to receive less favorable placements. We have experienced fluctuations in organic rankings for a number of our owned and operated and our 3rd-party publishers' websites and some of our paid listing campaigns have also been harmed past search engine algorithmic changes. Search companies could make up one's mind that our or our 3rd-party publishers' websites' content is either not relevant or is of poor quality.

We believe it may merely be a matter of fourth dimension before Google recognizes QuinStreet's deceptive tactics and ends the business with a few swift clicks of its ain.

Determination

We believe that QuinStreet is a business concern that is structurally incapable of both providing value to stakeholders while also generating cash menstruation. The business was left for expressionless upon the collapse of the for-turn a profit education industry, yet the Visitor has been given new life via increasingly deceptive tactics in both generate leads and sell leads. However, these tactics, as well as its partnerships such equally those with All Web Leads and InsuraMatch, will ultimately prove toxic.

We believe this toxicity may exist pressuring the Company into taking even more desperate actions that could only accelerate its demise.

Every bit Progressive represented 24% of revenues in the nigh recent quarter, there is tremendous risk should the visitor make up one's mind its dollars are better spent elsewhere. Tremendous reliance on Google could prove detrimental were Google to nowadays another algorithm change.

Finally, the FCC has issued three 9-figure fines in the past 6 months alone, and Chairman Ajit Pai is no doubt watching. Given the Visitor'due south numerous declared ACPA and TCPA violations, which nosotros believe have only increased in volume and severity over the past two years, potential liability could be a massive balance sheet event, and increased post-fine regulation would probable render the business organisation once again incapable of producing profits.

Our cost target of $2 per share implies ~80% downside, all the same we believe is generous for the shares given that we believe the Visitor is structurally incapable of producing cash, has just $i.10 per share of cash on the residue sheet, and may confront hefty fines.

This commodity was written past

Investigative Investment Enquiry. . . . . . . . . . . . . . . . . . . . . . . . . .

Disclosure: I am/we are short QNST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for information technology (other than from Seeking Blastoff). I accept no business relationship with whatsoever company whose stock is mentioned in this commodity.

Does Philip Roesel The Owner Of Credit Card Services,

Source: https://seekingalpha.com/article/4138748-quinstreet-move-this-spam-company-to-your-junk-folder

Posted by: sandershunne1994.blogspot.com

0 Response to "Does Philip Roesel The Owner Of Credit Card Services"

Post a Comment